The last time I wrote a blog post about finances was in November...2011. The home budgeting for this year was probably so scary to look at that I avoided it like the plague.

Back when stayed in our Bukit Jalil apartment (all the way until Sarah gave birth), we used the envelope system of budgeting. This basically involved setting aside cash in envelopes for budgeted items, using cash for every purchase and not spending more than was put aside.

This worked for us because we didn't use our credit cards (sometime we would for petrol but we'd take out the cash directly from the envelope the same day) - we could tangibly feel the money being spent when it was cash, and therefore we spent less. At the same time, Sarah would sometimes forget she had money in some of her envelopes and when she thought she had no money left, she was much less inclined to spend, especially on ministry.

But once we moved to the new apartment and the baby came along, somehow we got too busy to set up the same system again although we wanted to. And this is not to say we've been irresponsible with our spending; there have just been some months which have gone by where we were left scratching our heads and wondering why we're in the red...again.

To be honest, if I were average out our last one year, we have spent more than we earned. We're always hovering slightly in the red month by month, with some months where we just about break even. And so we've very slowly worked into what little savings we had across the year.

The leakage hasn't been huge. It could be just couple of hundred Ringgit in a month or once in awhile it might be more due to unexpected expenditure but it all adds up.

I visited my sister and brother in Singapore recently and they were talking about how they pass significant sums to their financial planners every month to invest and save for them. They said they couldn't understand those who couldn't save and how they could live 'hand to mouth' every month. I kept quiet and did not have the heart to tell them I was one of those.

Recently, I felt strongly enough about our family finances to implement something. It wasn't so much that I was concerned about our spending habits because I know we're pretty careful and thrifty by nature, but it was so that I could have a better understanding of the financial health of my family. This would presumably help me plan and prepare better, and not be caught off guard suddenly.

The first step was to ensure that every expenditure was captured. This was honestly the toughest step because I'm not that strong administratively by nature, and Sarah is 10 times worse than me. But I set up a Google Docs Excel sheet, and my wife and I committed to filling it in everyday with every single purchase, no matter how small.

The second step was to work out a budget where I listed out the main categories and set a realistic percentage of the family income to target for each category's expenditure. The actual spending was then compared to these targets every month to be a gauge of whether we were in a healthy place financially.

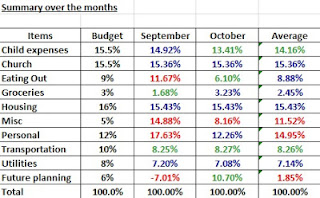

I'm happy to say that we've managed to maintain it for over two months now. And here's a summary of what it looks like (without revealing any specific numbers of course!).

In September, you can see that we were doing terribly in three categories: Eating Out (too many salmon sashimi cravings), Miscellaneous (weddings, funerals and full moons for babies) and Personal (we bought some new clothes). The rest were pretty on track - grocery spending was very low because we hardly eat at home and transportation has been cheap since I started taking the train.

In October, we looked at some of these problem areas and did much better. We almost halved our 'Eating Out' but I realise we didn't pick up the bill much with both our parents, we reduced our 'Miscellaneous' but still spent over the budget (so many people getting married and having babies!), and we didn't buy anything for ourselves. We even spent less for 'Child Expenses' because we still had milk powder to last the month but in November, it will shoot up again because we have to restock.

So there you have it, a quick snapshot of the family finances and a bit of an insight into how a family without a large combined income try to make sense of the numbers and find a way to work things out.

Throughout the year, God has been so faithful - if I go into the detail of the calculations, there's no way we would have been able to comfortably make things work with the level of expenditure we have. He has come through every time, using people around us and situations to continually assure us that it is all in His hands.

Although we may have shaved our own savings slowly away, we haven't touched the money given to baby Nat for her full moon and birthday, and have been able to set it aside in a fixed deposit for her future education. And no matter how close we cut it every month, we have such full, comfortable lives, lacking in nothing but always with more than enough.

That's how it always is with God, isn't it? You just have to keep the big picture in mind.

0 comments:

Post a Comment